A blueprint for bill support: How automation and targeted design can transform essential services

Four million people cannot afford everyday essentials. Our latest research, in collaboration with Citizens Advice and IPPR, sets out a blueprint to deliver urgently needed, effective, and automatable cost of living bill support across four essential markets: energy, water, broadband and motor insurance.

Current models of bill support are failing to reach those most in need, with our Missing Out 2025 report estimating that seven and a half million families are missing out on £3 billion of support in the water, broadband and energy markets.

However, as our Policy in Practice work on The Art of the Possible and pioneering projects with councils and organisations like Anglian Water, Thames Water, and British Gas Energy Trust have demonstrated, the mechanisms to get support to those who need it most already exist.

“Rising bills mean more people are needing to navigate a fragmented network of support. This report shows how policymakers can make schemes easier to navigate, even auto-enrolling a growing number of households, ensuring support gets to those households who are struggling the most.”

The problem: current bill support is falling short

In 2025, half of the people who came to Citizens Advice for debt advice were in a negative budget, meaning their essential outgoings exceeded their income. This strain is visible across essential markets:

- Almost one in five (19%) bill payers can’t always afford their water bills, with 42% of that group cutting back on essentials like groceries and energy

- One in four people (27%) with fixed broadband on very low incomes have cut back on essentials or fallen behind on other bills

- There is currently no targeted support in the motor insurance market, despite nearly one in five drivers (18%) having to borrow or cut back to pay their premiums

It is essential to support these people to prevent downstream demand on healthcare, social care, homelessness, and other services. It is also a vital first step to supporting people into employment. It is hard to get people to engage with training and employment support services when they are in acute financial distress.

Low uptake is a major contributor to this failure. For example, the uptake for home broadband social tariffs is currently only 1 in 10 eligible households. This is a stark contrast to the Warm Home Discount (WHD), which auto-enrols around 7 in 10 eligible households.

The blueprint: targeted, effective and automatable bill support

The new blueprint proposes a package of measures that, taken together, could provide a struggling household with over £950 of bill discounts per year.

The key to achieving this scale and impact is automation. This means designing schemes that use readily available data, making the process low friction for the customer, and ensuring equitable access to support.

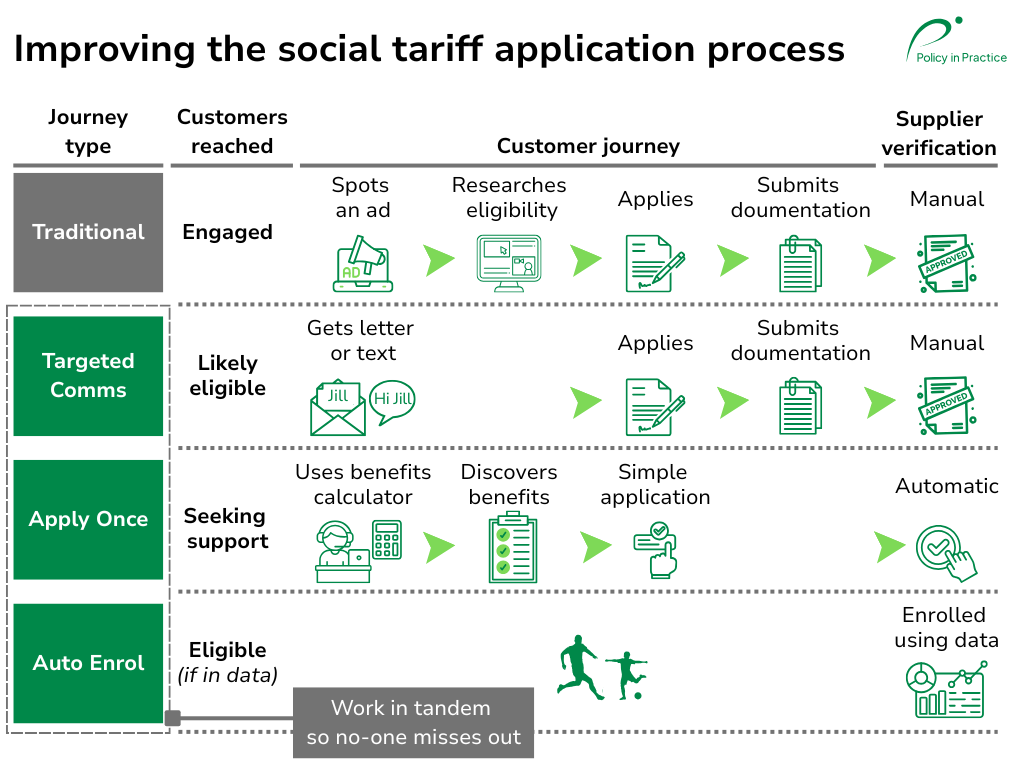

As detailed in our paper, Data sharing for implementing targeted bill support blueprints, Policy in Practice highlights three proven ways to increase uptake using data:

- Auto enrol: Puts people onto a tariff automatically if government data confirms they qualify, skipping the need for any application

- Apply Once: Streamlines access by assessing eligibility as part of a routine benefits calculation, such as a Citizens Advice advisor may do with a client struggling with their finances using our Better Off Calculator; eligible users easily discover what they can claim and can “click to apply” without re-entering data

- Targeted communications: Councils contact likely eligible customers directly, informing them individually of their eligibility, which significantly increases take up

Policy in Practice has developed software for utility providers to improve the application process for social tariffs

Citizens Advice’s proposed market interventions

The core of this blueprint is a set of specific interventions designed by Citizens Advice to solve the affordability crisis in the four markets of energy, water, broadband and motor insurance

| Market | Citizens Advice's proposal | Household annual support | Automation route |

|---|---|---|---|

| Energy | Expand the Warm Home Discount with tiered support based on energy need | £160-£560 (in addition to current WHD) | Auto Enrolment |

| Water | Single national social tariff based on income and water poverty criteria | Average £273 | Auto Enrolment or Apply with API Verification |

| Broadband | New £120 per year voucher alongside improvements to streamline social tariffs | £120 | Auto Enrolment |

| Motor insurance | Discount voucher for households on means tested benefits | £200 | Apply with API Verification |

Three things utility companies can do now

Utility companies can dramatically increase take up and reduce administrative costs by implementing the strategies we have developed in partnership with the sector:

- Implement Apply Once: As pioneered by Anglian Water, integrating social tariff eligibility checks directly into benefits calculators (like our Better Off Calculator) reaches people when they are already seeking financial support. This allows customers to “click to apply” using the data they have just entered, dramatically shortening the application process

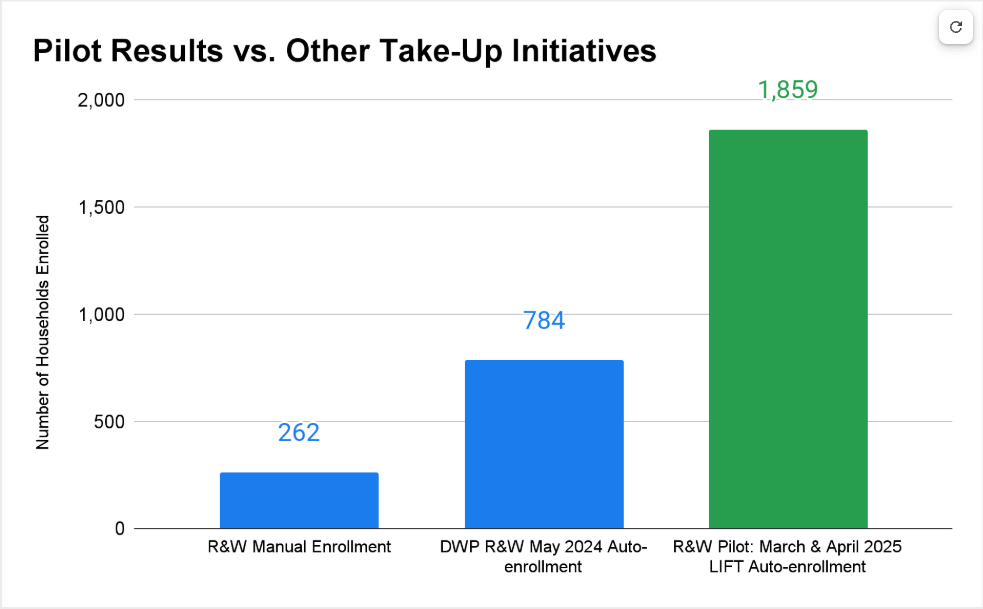

- Scale auto-enrolment: Thames Water’s successful pilot, which used data matching to automatically enrol thousands of families onto their WaterHelp social tariff, proves that automating complex eligibility criteria like water poverty is feasible and highly effective, bypassing the need for customers to apply manually

- Use Trusted Third Parties (TTPs) to identify eligibility: For complex, cross-sector data matching, such as calculating water poverty, which requires both DWP benefit data and utility bill information, TTPs like Policy in Practice provide a secure, private means of verifying eligibility without the cost and criticism if utility companies hold sensitive government data

Two things local authorities can do now

Local authorities hold unique, rich datasets and often act as the first point of contact for struggling families. They can leverage data analytics to:

- Run targeted take up campaigns: Using benefits data they already hold about local residents, councils can send personalised, targeted letters about national and local bill support schemes, just as the Greater London Authority achieved with Pension Credit, boosting take up rates well above the industry average

- Integrate application tools: Encourage all front line staff who deal with financial distress to use benefits calculators that include social tariffs and, where possible, that integrate with social tariff application processes in an Apply Once journey, ensuring that essential support is surfaced at the critical moment

The blueprint and our ongoing work show that the challenge is not whether we can deliver targeted support, but whether we choose to adopt the modern, data driven approaches needed to ensure no one misses out on essential help.

Case study: Water company, councils and Policy in Practice partner to deliver automatic bill support worth £10 million for low income households

Using Policy in Practice’s LIFT platform, councils and Thames Water can now securely identify households struggling with rising costs and automatically enrol them for financial help, removing the need for lengthy applications.

With water bills up 26% on average over the past year, the support provides vital relief to those who need it most, as covered by BBC News.

A pioneering partnership between Thames Water, London boroughs and Policy in Practice ensures Londoners automatically receive water bill support, a first for the UK water industry

The initiative builds on a successful pilot that’s expected to reach 33,000 households, delivering over £10 million in savings